ensuring reliability and transparency

Do you want to reduce the time and resources of specialists for the preparation of consolidated accounting?

Would you like to increase the reliability of the consolidated accounting and the transparency of all stages of the consolidation procedures?

Do you feel a need to quickly and conveniently reconcile, adjust and eliminate intra-group turnovers for the prompt generation of consolidated accounting along any consolidation perimeter?

A team of professional financiers, methodologists, technical consultants will offer you the best modern methods and specialised tools for building consolidated accounting in your company. We will deeply work out your accounting systems' specifics, stakeholder requirements for consolidation standards and make the consolidation procedures as fast, convenient and verifiable as possible. Your internal and external auditors will be satisfied with the quality of the consolidated accounting.

How do we do this?

Our financiers and methodologists will:

- examine carefully your existing processes for the consolidated accounting formation for setting tasks for technical specialists or offer you the development of a preparing methodology for consolidated accounting from scratch;

- analyze all the problems and bottlenecks that arise or may arise within the procedures for the formation of consolidated accounting, and offer options for solving problems;

- offer options for consolidating accounting using full and proportional consolidation methods, following the equity method;

- develop approaches for the ability to form an arbitrary consolidation perimeter with a change in the applied consolidation methods;

- develop a methodology for reconciliation, alignment, matching and exclusion of intra-group transactions along a given consolidation perimeter;

- develop a methodology for converting foreign currencies into the currency of consolidated accounting presentation, and formalize a method for calculating adjustments from currency conversion;

- implement algorithms for the automatic calculation of uncontrolled ownership interests for presentation in the consolidated accounting.

Our IT specialists and developers will:

-

automate the process of reconciliation and elimination of intra-group turnovers between enterprises included in the consolidation perimeter;

-

automate the implementation of transformational and consolidation adjustments;

-

implement automatic loading of data from your systems necessary for the formation of consolidated accounting;

-

create a tool that allows setting an arbitrary consolidation perimeter, and ensure the ability to change consolidation methods and methods for calculating uncontrolled ownership interests;

-

create automatic checks and alerts for each stage of data preparation and the formation of consolidated accounting, set up a tool for auditing changes in data;

-

set up automated business processes and workflows for the formation of consolidated accounting, propose and configure the differentiation of access to information;

-

support your employees at all stages of consolidated accounting.

.

We have professional financiers, a methodological base, technical specialists, experience in project implementation and modern IT tools to automate the process of generating consolidated accounting in your company.

On what platforms is the consolidated accounting system implemented, and what does it look like?

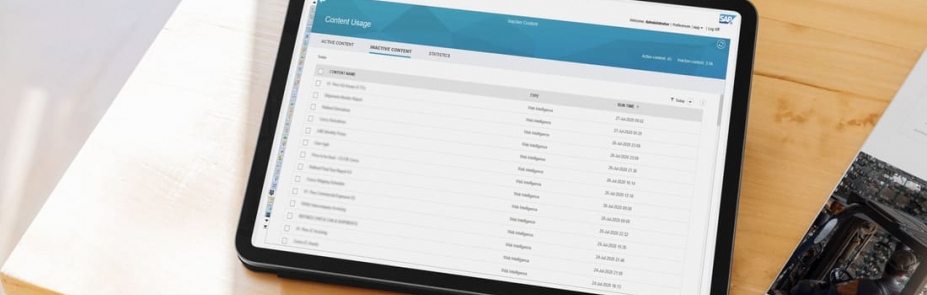

SAP Business Planning and Consolidation (SAP BPC) is a professional system for organising consolidated accounting following IFRS, for preparing consolidated budgets and management accounting.

The system allows automating the processes of consolidating accounting for companies groups of any size, significantly reduces the time for preparing consolidated accounting, increases the reliability, transparency and verifiability of data at all stages of the formation of consolidated accounting.